Risk Watcher

Sample Screens

PECTEN

Transform your ESG strategy

Schedule a demo today to learn more about how Pecten can help you achieve your ESG goals.

About Us

Our Journey Towards ESG Excellence

Pecten began with a vision: to make sustainability quantifiable and measurable, bridging the gap between ideals and actions. We started as a small team of passionate individuals with a shared belief in the power of AI to drive responsible investments. Our journey is a testament to our commitment to transform ideals into actionable insights. Today, Pecten stands as your partner in the world of responsible investing, driven by the unwavering pursuit of positive change.

Schedule a demo today to learn more about how Pecten can help you achieve your ESG goals.

Automated ESG Data: Taxonomy and Collection

Key Features

Smart ESG Taxonomy Mapping

ESG Risk Assessment and Mitigation

Multi-framework Support

Pecten is not just another ESG platform; it's a game-changer in ESG reporting and management. Our platform brings the following unique features to your fingertips:

Predictive Capabilities

Real Time Tracking and Monitoring

AI Augmented Platform

Schedule a demo today to learn more about how Pecten can help you achieve your ESG goals.

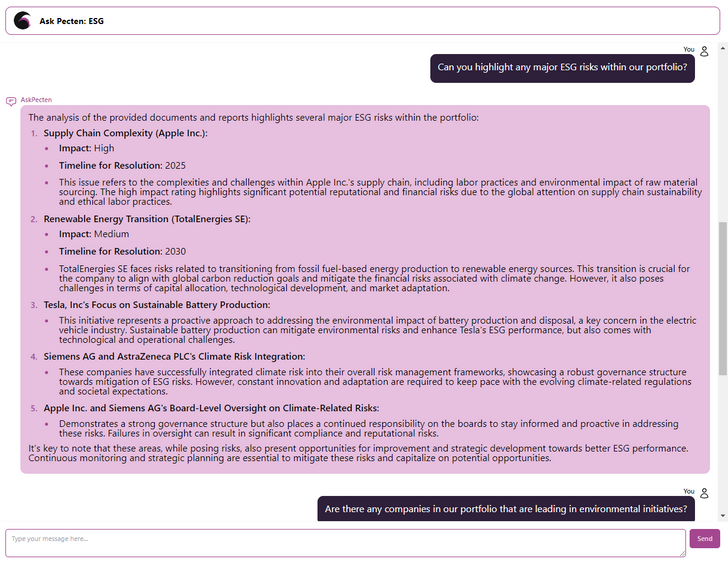

Pecten’s ESG Assistant

Gain instant access to AI-powered ESG insights with our interactive chat interface, making expert advice accessible to every team member, enhancing decision-making.

The Assistant analyses current performance and benchmarks, then suggests customized strategies, showcasing immediate value.

Exclusive to Pecten, this patented conversational AI model allows access to ESG intelligence across your organization.

Schedule a demo today to learn more about how Pecten can help you achieve your ESG goals.

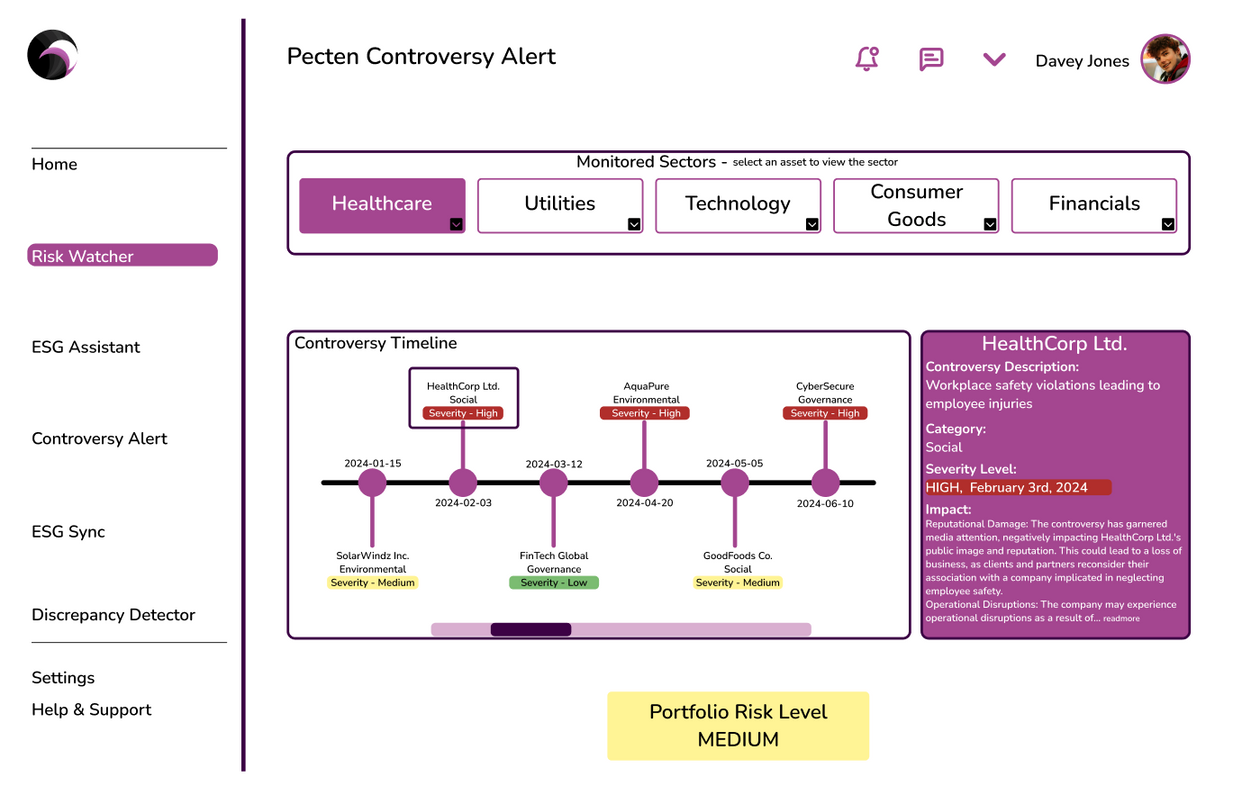

Pecten’s Controversy Alert

Real-Time Controversy Alerts

Monitor potential controversies and reputational risks in real time, ensuring you're always ready to respond to emerging challenges with informed action.

By analyzing sentiment trends in real-time, Controversy Alert detects emerging threats. Its use of generative AI to formulate response strategies ensures you’re prepared to act decisively.

Interactive Controversy Timeline

Advanced Filtering and Search Tools

Actionable Insights and Recommendations

Schedule a demo today to learn more about how Pecten can help you achieve your ESG goals.

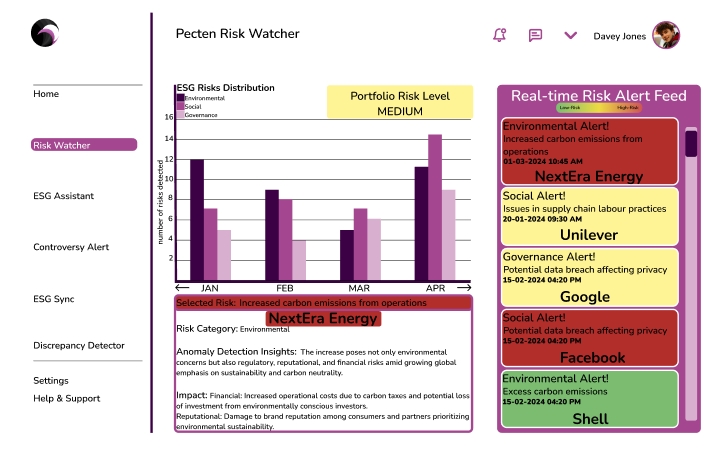

Pecten’s Risk Watcher

We collaborate closely with our clients, customizing solutions to help achieve your sustainability objectives.

Sustainability Data Collection

Climate,Portfolio,Investor-Grade ESG Risk Reporting

Real-time Tracking and Alerting

Trend Analysis, Diagnostics and Predictive Capabilities

ESG Benchmarking

Portfolio Overview and Risk Monitoring

"Unlocking Sustainable Success with Pecten"

Empowering Sustainability Excellence

Seamlessly integrate diverse data sources and frameworks, including ESG

Deliver real-time insights and intelligence for informed decision-making

AI-Enhanced ESG Excellence

Harness the power of AI for sustainable and resilient outcomes

Bridge the gap between data, insights, and impact

Provide dynamic adaptability

Become a trusted partner in achieving sustainability goals

Streamlining ESG Reporting

Simplify sustainability reporting

Provide real-time insights and intelligence

Schedule a demo today to learn more about how Pecten can help you achieve your ESG goals.

Case Studies

DAX Index Benchmarking

Pecten's ESG-recommended portfolio outperformed the DAX index by 2.3% over the long term, while also being less risky. This demonstrates the value of Pecten's ESG integration approach, which helps investors identify and invest in companies that are well-positioned to manage ESG risks and opportunities.

One way to use Pecten's ESG-recommended portfolio is to benchmark it against the DAX index. This can help investors to track the performance of their portfolio relative to the broader market, and to assess the impact of their ESG integration strategy.

For example, an investor could compare the annual return of their Pecten ESG-recommended portfolio to the annual return of the DAX index. Over the long term, the investor would expect the Pecten ESG-recommended portfolio to outperform the DAX index, given its superior risk-adjusted performance.

~Pecten's ESG-recommended portfolio outperformed the DAX index by 2.3% over the long term

~Pecten's portfolio was also less risky than the DAX index

~Investors who followed Pecten's advice were able to achieve higher returns with less risk

Risk Monitoring and Mitigation

Through the use of ESG risk monitoring and mitigation, Pecten was able to assist investors in avoiding the Volkswagen emissions scandal. By monitoring news sentiment and other ESG risk indicators, Pecten was able to detect the negative news surrounding the company early on. Pecten then recommended that investors limit their holdings in Volkswagen. This resulted in investors being able to evade substantial losses.

~A focus on one particular company and incident (Volkswagen emissions scandal)

~Strong action verbs that convey Pecten's effectiveness (identify, recommend, and avoid)

~The demonstration of how Pecten's ESG risk monitoring and mitigation capabilities can be beneficial (investors avoided significant losses)

Schedule a demo today to learn more about how Pecten can help you achieve your ESG goals.

Schedule a demo today to learn more about how Pecten can help you achieve your ESG goals.